Tranalysis

Implementing eight major financial opening measures in Shanghai, steadily expanding the institutional opening of finance... On June 18th, at the 2025 Lujiazui Forum, authoritative voices from the central bank and the State Financial Regulatory Administration released multiple signals. At the same time, the 2025 China International Financial Exhibition (hereinafter referred to as \Financial Exhibition\) was held at the Shanghai World Expo Exhibition & Convention Center. This Financial Exhibition, themed \Open Innovation, Technology Empowerment, Co-creating the Financial Future,\ is deeply linked with the 2025 Lujiazui Forum.

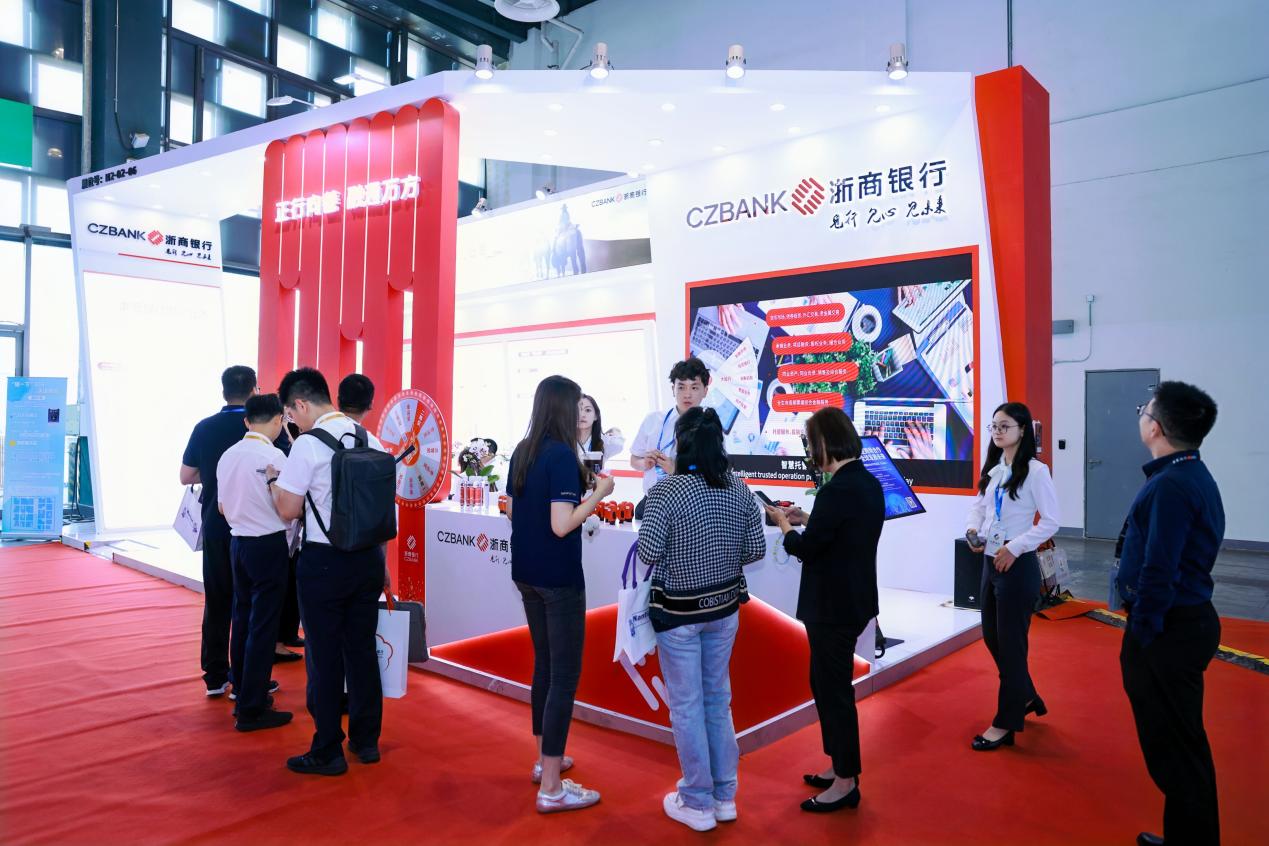

Zhejiang Commercial Bank, with the design concept of \goodness\ and \numbers,\ participated in the exhibition for the first time and, as the first legal entity bank in Zhejiang Province to directly participate in CIPS (Cross-Border Interbank Payment System), was invited to participate in the CIPS cross-border bank-enterprise cooperation special event. The bank systematically showcased its cross-border financial service system, further implementing regulatory requirements for high-level openness, and fully supporting enterprises to \set sail overseas.\

It is reported that this is also one of the series of activities of Zheshang Bank to \financially support common prosperity\. The scene is set up with \Zhejiang Bank LIVE live broadcast area\, \Science and Innovation Finance Robot area\, \Good Book Finance publicity area\ and other 7 major areas. Through rolling live broadcasts, on-site interaction with robot dogs, and game cosplay, it showcases the practical exploration in the fields of technology finance and inclusive finance, and promotes the integrated development of technological innovation and industrial innovation.

With \goodness\ as the soul, let cross-border services \warm up\.

In the \Shanben Financial Exhibition Area\, business clients and experts from various regions come in an endless stream, engaging in in-depth communication with representatives of the financial consultants of Zheshang Bank, and experiencing on-site the development trajectory of the concept and practice of Shanben Finance in recent years.

From financial goodness to goodness-based finance, Zhejiang Commercial Bank has established a comprehensive \six-pillar\ system, including the financial advisory system, county-level financial comprehensive ecological construction model, and Zhejiang Bank Good Standards, deeply embedding the \good\ gene into financial service scenarios. Recently, the bank has focused on 8 major aspects to launch 20 measures, carrying out a \snow in the time of need\ project with 10 billion yuan of special assistance funds, especially planning to provide no less than 17 billion US dollars for cross-border financing to private enterprises throughout the year, supporting foreign trade enterprises to move forward steadily in a complex environment.

At Zhejiang Yiwu Ziqin Arts & Crafts Co., Ltd., founder Nie Ziqin, facing changes in U.S. tariff policies, once confidently responded to a question from a CNN reporter: \If the United States does not want (Halloween products), then I will distribute them to other customers.\ This composure is also due to the support of financial institutions such as Zhejiang Merchants Bank for its transformation and layout: the bank's provision of guaranteed loans, pledged loans, credit loans, and other financial \escort combinations\ have given Nie Ziqin the confidence of real money to develop markets in other countries. \We integrate the 'good' gene into our business products, increase support efforts, and ensure that financial services can reach these foreign trade enterprises directly. As of the end of May, the foreign trade enterprises we have connected have been granted a total of over 140 billion yuan in credit,\ said the person in charge of the International Business Department of Zhejiang Merchants Bank.

It is worth mentioning that this time, the Zheshang Bank was also invited to participate in the CIPS Cross-Border Banking and Corporate Cooperation Special Event, systematically showcasing the bank's cross-border financial service system: by providing a set of global account and settlement, integrated liquidity lending and other cross-border financial services, creating a full life cycle cross-border financial service \Zhejiang Silk Road Finance\ and a one-stop foreign exchange trading platform \Zhejiang Global Transaction Treasure\ two golden business cards, actively supporting enterprises to deeply participate in international economic and trade capacity cooperation. At the same time, it fully leverages the direct participation advantage of CIPS to improve the efficiency of cross-border RMB settlement, enrich service scenarios. It is reported that in the past 4 years, the bank's cross-border RMB settlement volume has a compound annual growth rate of nearly 40%, and the proportion of cross-border settlement in local currency has increased by nearly 20%.

Use \numbers\ to make technology finance \active\.

In the \Tech Innovation Finance Robot Exhibition Area\, the new generation of robots particularly caught the eye. The M5F material handling robot brought by Shanghai Quick Warehouse Intelligent Technology Co., Ltd. demonstrated horizontal material transportation and docking tasks on site, with a maximum moving speed of up to 4.5 meters per second, and through human-machine engineering design adapted to complex warehouse scenarios, greatly improving the efficiency of warehouse operations. The popular \robot dog\ brought by Hangzhou Yunshen Technology Co., Ltd. interacted warmly with visitors, attracting many spectators to stop and take photos.

\Zheshang Bank, through the 'Science Companion Program', has supported numerous technology companies, including Quick Warehouse Intelligence.\ Reporters learned from the exhibition staff that as early as 2016, Zheshang Bank innovatively seized the \human\ factor in technology companies, shifting the company evaluation from \counting bricks, looking at mortgages, and looking at history\ to \counting patents, looking at value, and looking at the future\, building a \companion support network\ in various dimensions such as personnel companionship, scenario companionship, product companionship, and ecological companionship. As of the end of the first quarter of 2025, the bank has served more than 32,000 technology companies, with a financing balance exceeding 400 billion yuan, and plans to achieve an additional 10 billion yuan in technology finance loans for the whole year, continuing to empower the development of enterprises.

Online \traffic\ boosts exhibition \retention\, and the \Zhejiang Bank LIVE live broadcast area\ has become a highlight of this financial exhibition. Focusing on a series of livelihood topics such as resident consumption and wealth management value-added, Zhejiang Commercial Bank has continuously carried out five live broadcast activities including credit cards, chain ecological finance, foreign exchange information and strategies, and wealth strategies, to meet the diverse investment and financing needs of customers, inject \cloud power\ into common prosperity, and the number of online viewers exceeded one million.

At the financial exhibition, Zheshang Bank also displayed a variety of \Digital Zheshang\ financial services such as individual pension and supply chain finance, and set up immersive interactions like financial fraud prevention, showcasing the bank's innovative practices in leveraging finance to promote common prosperity through digital technology.

It is reported that this exhibition is guided by the People's Bank of China, supported by the Shanghai Municipal Committee and Municipal Government, hosted by the China Financial Electronics Group, and co-organized by cross-border clearing companies, among others. The person in charge of Zheshang Bank said that they hope to use the platform of the International Finance Exhibition and the Lujiazui Forum to further demonstrate Zheshang Bank's steadfastness in deeply grasping the political nature and people-oriented nature of financial work, and their determination to build a high-quality demonstration zone for common prosperity. In the future, Zheshang Bank will continue to focus on benevolent finance as the anchor point, serving the financial needs of key areas and key customer groups such as foreign trade, technology, and consumption, and creating a Zheshang practice model to help finance common prosperity.