Tranalysis

On October 28, Hong Kong stocks Cinda Biotech (01801.HK) fell sharply, falling 13.79% at the highest intraday session and closing down 12.54%.

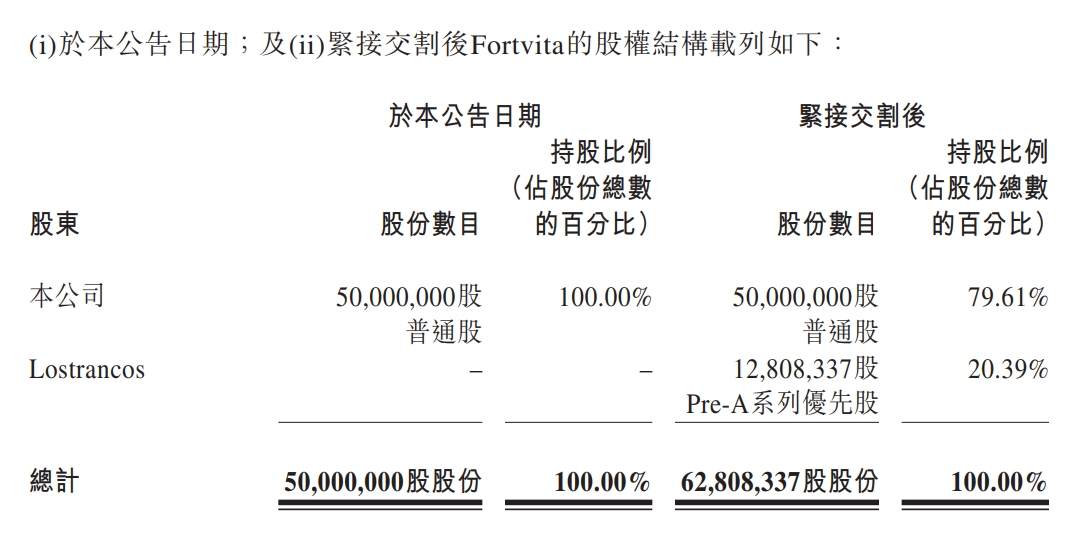

On the news front, on October 25, Cinda Biotech issued a related party transaction announcement stating that on the same day (after trading hours), a wholly-owned subsidiary Fortvita entered into a subscription agreement with Lostrancos. Lostrancos conditionally agreed to subscribe and purchase at the subscription price, while Fortvita conditionally agreed to issue and sell the subscription shares at the subscription price, at a subscription price of US$20.5 million, approximately RMB 146 million. After the delivery, the equity in Fortvita directly held by Cinda Biotech will be diluted from 100% to 79.61%, while Lostrancos will directly hold 20.39%. Fortvita will become a non-wholly owned subsidiary of Cinda Biotech.

Changes in Fortvita's shareholding structure before and after delivery

The above transactions constitute connected transactions. The announcement shows that Yu Dechao, executive director of Cinda Biotech, is the sole director of Lostrancos. After the settlement, Lostrancos will be held 82.93% by Yu Dechao, and 17.07% will be jointly held by Xi Hao, executive director of the company, and another investor (an independent third party).

Yu Dechao is not only an executive director of Cinda Biotech. According to official website information, he is also the founder, chairman and CEO of Cinda Biotech. He is mainly responsible for Cinda Biotech's overall strategic planning, business direction control and management. Xi Hao, who also holds a stake in Lostrancos, serves as an executive director of Cinda Biotech and participates in the company's strategic and business decisions. He also serves as a fund management partner of the group. From August 2017 to February 2024, he also served as Cinda Biotech Chief Financial Officer.

In other words, Cinda Biotech sold the equity of its original wholly-owned subsidiary, and the transaction object was one of its own. Regarding the purpose of this transaction, the announcement stated that the proposed subscription is a good start for Cinda Biotech to develop its international business, and the direct investment by key members of the management fully reflects their long-term and firm investment and determination to develop overseas business, and also enables them to play a more direct and active role in Fortvita's future growth and development.

Regarding the financial impact of this transaction on the company, Cinda Biotech stated that as the parent company of Fortvita, Cinda Biotech will continue to lead and promote its development, continue to enjoy the potential economic benefits brought by Fortvita, and aim to provide long-term benefits to the company's shareholders. Sustainable returns. Fortvita Group's operating results and financial position will continue to be incorporated into the Group's consolidated financial statements. The deemed disposal is not expected to cause any significant gains or losses to the company's consolidated statement of profit or loss and other comprehensive income, and the deemed disposal will not have a significant financial impact on the Group.

So, why did Cinda Biotech's share price plummet after the transaction was disclosed? Some investors believe that this related party transaction is a new path for domestic innovative drugs to go abroad, while others believe that "management looks ugly."

The subscription price was reached through arm's length negotiation between Fortvita and Lostrancos, taking into account Fortvita's valuation of US$80.026 million as of October 8, 2024. What makes some investors question is why the reference price adopts the asset-based approach.

The announcement stated that independent valuers used an asset-based approach to analyze Fortvita's market value, that is, valuing each identifiable asset and liability using an appropriate valuation method, then calculating the total value of all assets and subtracting the total liability. As of the base date, Fortvita's total valued assets were approximately US$234.02 million, mainly comprising bank balances and cash, prepayments and other receivables, machinery and equipment, intangible assets and right-of-use assets, while Fortvita's total valued liabilities were approximately US$154 million, mainly comprising borrowings, trade payables and other payables and accruals.

Regarding valuation methods, Cinda Biotech introduced that independent valuers consider three valuation methods when selecting valuation methods, namely asset-based method, income method and market method. Given that Fortvita's pipeline is mainly focused on early detection and preclinical stages, and there are no major milestones in overseas clinical trials. In addition, considering the inherent risks associated with clinical trials, commercialization and production, there is no reliable financial forecast from Fortvita, so the income approach cannot be used. In addition, considering the nature of Fortvita's business and its stage of development, there are no comparable companies or transactions on the open market, so market laws are not applicable. Given that each of Fortvita's identifiable assets and liabilities can be effectively valued using appropriate valuation methods, the independent valuer believes that the asset-based approach is the most appropriate method for conducting market valuation analysis.

The transaction was also linked by some investors to Yu Dechao's reduction in Cinda Biotech. According to data released by the Hong Kong Stock Exchange on October 4, Yu Dechao reduced his holdings by a total of 3.25 million shares on September 30 and October 2, with a total amount of approximately HK$152 million. After reducing the shareholding, Yu Dechao's share fell from 7.9% to 7.7%.

Founded in 2011, Cinda Biotech is committed to developing, producing and selling innovative drugs in major disease fields such as oncology, autoimmune, metabolism, and ophthalmology. It was listed on the main board of The Stock Exchange of Hong Kong Limited in October 2018. The 2024 semi-annual report shows that the company is developing 36 pipelines, and 11 products have been approved for marketing, including the domestic PD-1 oncology drug sintilumab.

The 2024 semi-annual report shows that Cinda Biotech's revenue was 3.952 billion yuan, a year-on-year increase of 46.3%; it lost 393 million yuan, a year-on-year increase of 254 million yuan. As for the increase in losses, Cinda Biotech stated that it was mainly due to a decrease in net exchange gain on non-cash items and a decrease in one-time income tax credit.

In the past two years, Cinda Biotech has also laid out the popular GLP-1 drug track and is at the forefront of domestic drugs. The 2024 semi-annual report shows that two NDA (New Drug Registration Applications) for the GLP-1/GCG dual agonist maslidotide have been accepted in China and are expected to be approved for marketing soon. Indications include long-term weight management for obese or overweight people. and treatment of type 2 diabetes.