China's citric acid exports rebound The largest citric acid producer in the word, China, has finally see rebounds in the export volume of citric acid in March 2017. As more than 70% of China’s huge citric acid production is being exported, the export volume is actually China’s largest amount of active pharmaceutical ingredients.

Source: Pexels

While the output of China’s citric acid production was constantly going up from 2011 to 2016, the capacity on the other hand went down in average in the same period. This shows the increasing consumption of citric acid in China domestically as well as the rising export volume throughout the years.

However, China’s citric acid export are often the target of anti-dumping measurements from other countries. Some examples for these accusations are Brazil recently in November 2016, when the country decided to launch anti-dumping investigations and Ukraine in October 2016, which levied a temporary 130% anti-dumping duty on China’s citric acid. The USA even started back in 2000 to launch the first anti-dumping investigations against China.

To be noticed, China is not the only country that faces anti-dumping investigations on citric acids exports. Recently, an American company has filed an anti-dumping duty petition also against citric acid imports from Belgium, Colombia, and Thailand. According to the petition, The dumping margins should be around 118% for Belgium, 49% for Colombia, and 61% for Thailand. The deadline for the final injury determination is on June 28, 2018.

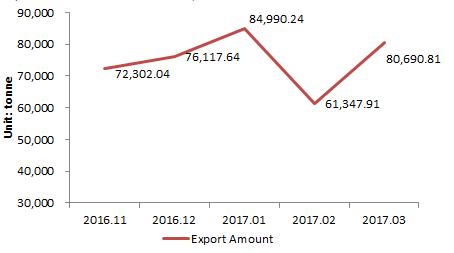

Weak overseas demand for China’s citric acid has caused a slack export volume in recent years. While many active pharmaceutical ingredients exports in China even witnessed a decline, the volume of citric acids remained comparatively high. In February, the volume saw a sudden drop by more than 23,000 tonnes. However, the month March demonstrated the rebound of the export volume again. Even the volume was still lower than in January 2017, it exceeded the ones from December and November 2016.

Export volume of citric acid in China, Nov. 2016 to March 2017

Source: Tranalysis

What’s more, the export destination of China’s citric acid is very diversified. The largest importer is India, having a share of about 8% of China’s exports. Further nations are Turkey, the Netherlands and Japan. The USA, which was the biggest destination in earlier years, has lost its share due to the anti-dumping measurements.

China’s citric acid price was traditionally up to 20% lower than the one of other countries. The manufacturers hoped to gain some market share with this measurement. Even the increasing labour costs and environmental pressure has not yet caused a price increase, since the market situation in China is fierce.

China can use the exports of citric acid to avoid a prohibition of the World Trade Organisation on outright corn exports. Due to the corn stockpile strategy of China’s government, the country has gathered almost half of the world’s stock hold of corn. However, a switch in the agricultural policy last year has the authorities to abandon the stockpile and switch to subsidies for farmers instead.

The country now sits on a giant mountain of low quality corn, which China is prohibited to export due to the mentioned trade agreement. Hence, this corn can be processed into derivatives like citric acid to avoid the prohibition and reduce the huge corn stockpile trough processing and export.

Global citric acid market

The global citric acid market is expected to grow by an CAGR of about 6.2% until the year 2022. That growth factor will push the market value to over USD4 billion to that time.

According to market experts, Europe is expected to be the leading market for citric acids in the near future. Boosting demand from several industries, like the food and beverage industry as well as pharmaceuticals and personal care, is supporting this trend. However, the surging demand in emerging countries like India and China for packaged food is causing the APAC region to show the fastest growing market.

About Tranalysis

Tranalysis is an intelligence and analysis provider on import/export data covering over 15 industries in China. For more trade information of pesticides, including Import and Export analysis as well as Manufacturer to Buyer Tracking, contact our experts in trade analysis to get your answers today.

For more information about Tranalysis, please visit our website or get in touch with us directly by emailing mailto:econtact@tranalysis.comor calling +86-20-37616606.